Making an investment in Property For Novices

Real-estate purchase has long been acknowledged as an established method for developing prosperity, however first-timers may find it daunting to get around its difficulties and make sustained returns.

Novices trying to attain their economic goals can discover novice-pleasant investing methods using our assistance, tips and terms to obtain them started.

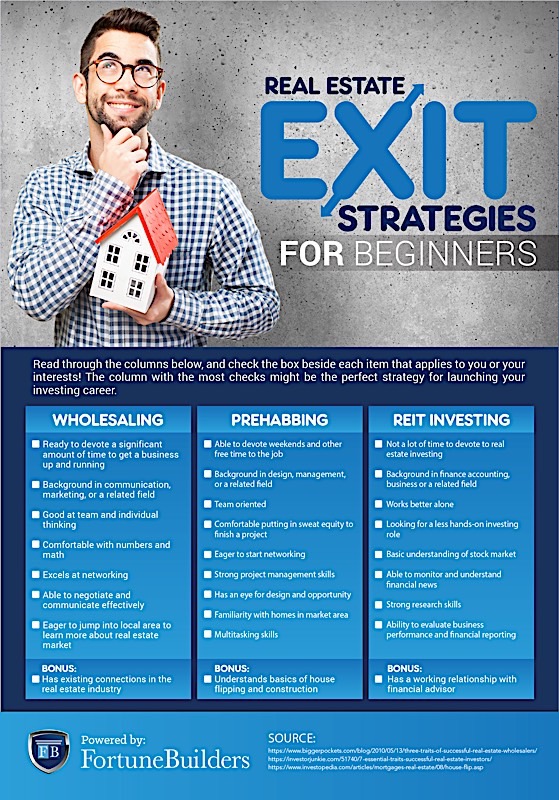

1. Property Expenditure Trusts (REITs)

REITs offer buyers an alternate technique for buying property without having our prime launch funds needed to obtain home straight, with decrease first investments than immediately buying real estate specifically. REITs are businesses that personal, operate or finance earnings-generating real estate across a variety of sectors - typically publicly dealt - offering investors with diverse real estate property resources at decrease minimal purchase sums than acquiring person properties directly. Traders can choose either equity REITs which individual bodily real-estate immediately themselves house loan REITs which keep loans on real estate or hybrid REITs which invest both forms.REITs can provide your profile with diversity rewards while they have lower correlations to bonds and stocks than their standard brethren, however they're not recession-resistant so it is best if you confer with your economic consultant concerning the amount of your profile must be dedicated to REITs based on your threat tolerance and goals.

These REITs give investors a chance to earnings through benefits that happen to be taxed as carry dividends, but buyers should bear in mind that REIT dividends might be affected by factors like shifting interest levels and changes in the real estate industry.

Depending on the kind of REIT you decide on, it is important that you analysis its fiscal past and recent functionality utilizing SEC's EDGAR method. Prior to making a choice to purchase or promote REIT shares, talk to a qualified dealer or fiscal counselor who are able to offer you updated market place learning ability and manual an informed selection - in this way ensuring you're getting optimum returns in your ventures.

2. Real Estate Property Expenditure Groups (REIGs)

As a beginner to property committing, the event could be both pricey and a little overwhelming. By becoming a member of a REIG you possess an ability to pool both time and money along with other brokers as a way to acquire returns easily with minimal operate needed on your part. REIGs are available both locally or on a national scale and work differently some fee registration costs while some don't also, distinct REIGs demand diverse amounts of fellow member contribution with a few having one organizer who handles every little thing although other may function a lot more as partnerships.No matter which REIG you pick out, it really is vitally important to conduct considerable investigation prior to shelling out. This might involve performing interviews and asking questions of firm staff and also examining previous earnings. You should also overview what investment technique your REIG pursues - is it focused entirely on turning properties easily or will they be looking at long-term cash flow technology through how to become a real estate wholesaler rental residence possession?

As with every kind of expense, REIGs can either advantage or harm you financially to discover one appropriate in your unique financial predicament and risk endurance is vital.

If you're interested in learning signing up for a REIG, begin your search on the web or via affiliate from other investors or industry experts. Once you find a stylish team, remember to talk to its coordinator and fully grasp their set goals and risks as well as capitalization level (also known as "cover") set up - this ratio aids compute expenditure residence values and ought to enjoy an important role when making selections about signing up for or making an REIG.

3. Property Syndication

Real estate property syndications enable traders to achieve contact with the market without having to be troubled with property development and managing duties on an continuous time frame. Real estate syndications involves an LLC framework consisting of a lively sponsor who manages investment capital elevating, acquisition, organization preparing for particular possessions passive brokers acquire distributions as outlined by a waterfall framework with first money efforts being distributed back and then distributed in accordance with a great come back objective (like 7% internal amount of profit (IRR).Brokers also love tax advantages as part of the investment package deal. Every year, they will be supplied a Timetable K-1 displaying their cash flow and failures for the syndication, as well as devaluation reductions as a result of price segregation and faster depreciation of property.

Expenditure trusts can be suitable for novices because of their lower amount of threat compared with immediate residence buys. But keep in mind that chance ranges depend on each and every case according to factors such as the neighborhood market place, house sort and business strategy plan.

To make a well informed selection about purchasing real estate property syndications, it's necessary that you perform homework. What this means is looking at trader supplies including project professional summaries, total expense overviews, trader webinars and recruit team keep track of data. When prepared, reserve your house from the deal by signing and looking at its PPM validate accreditation status well before electrical wiring money into their accounts.

4. Home Turning

Property turning is definitely an superb means for beginner property investors to make a profit by purchasing low and marketing great. Even though this job takes a lot of time and function, if done efficiently it might demonstrate highly profitable. Locating components with powerful profit potential in places people would like to stay is key here additionally enough funds also needs to be set-aside so that you can complete renovation of explained residence.Consequently, developing a crystal clear business strategy plan is of utmost importance for figuring out your targets and devising an motion intend to accomplish them. Moreover, experiencing one serves as an effective instrument when looking for brokers business strategy plan templates available online may aid in making one easily.

Starting modest may help you alleviate into this sort of expenditure more smoothly, and will allow you to fully familiarize yourself with its complexities faster. A robust support system - including building contractors, local plumbers, electricians etc. will be vital.

Rookie real-estate buyers may also look at REITs, that are businesses that very own and manage a variety of components like medical centers, industrial environments, shopping centers, and residential properties. Because they trade publicly wholesaling property on the carry trade they are them readily available for newbies.

Property making an investment may be highly fulfilling should you do your homework and try these tips. Considering the variety of available choices, there should be one ideal for you - but be wary to never overextend yourself financially prior to being all set if not it might lead to debts that can not be repaid.

5. Property Hacking

Residence hacking is undoubtedly an approach to real-estate that involves acquiring then leasing back a area of the acquired home to renters, providing newbies by having an ideal strategy to enter in the market without committing too much upfront. Month to month hire cash flow should cover home loan repayments so it helps swiftly create home equity.Residence hacking can also provide a fantastic possibility to fully familiarize yourself with as a property owner, since you will deal straight with tenants. Even so, be conscious that residence hacking is surely an unpredictable expense method sometimes leasing cash flow won't cover mortgage payments entirely monthly. Just before scuba diving in headfirst with this investing method it is important that comprehensive researching the market be carried out.

House hacking gives an additional benefit by helping lessen as well as get rid of housing fees completely. For example, purchasing a multifamily home which contains extra models you can rent out can make living in it more cost-effective when another person will pay your home loan payments directly.

Property hacking needs located in the house you rent consequently it is crucial that you like residing there long-term and feel comfortable with your setting. Additionally, it's necessary that you consider exactly how much function hiring out more than one devices at home will demand, such as evaluating prospective tenants, getting hire monthly payments and controlling renter issues.